Guest Opinion: Facebook and Asset Management: Where is the Love?

/Facebook has over two billion users: a following no other social media company has been able to achieve. Blackrock has over $6 trillion in assets: an amount no other asset manager has ever managed to best. If you search “Blackrock” on Facebook, however, you are likely to default to the “Blackrock Steakhouse” page, as Facebook search uses the number of fans to rank results. Blackrock Steakhouse, a restaurant in Lebanon known for its selection of Argentinian and Australian beef self-cooked on hot volcano rocks, has 25,000 Facebook fans. Blackrock the asset manager, meanwhile, has 22,000.

On LinkedIn and Twitter, though, Blackrock the asset manager has over 750,000 followers. And, not surprisingly, the rest of the asset management industry follows a similar pattern, which begs the question: Is Facebook simply not fit for asset management, or “conservative businesses” like finance and professional services? Or could the industry engage in more social selling by leveraging the largest social network on the planet?

No Facebook love for the asset management industry

Let’s examine how the world’s top asset managers perform. Taking the ten largest by assets under management (in 2017), and removing UBS and Allianz (number three and five) as they offer broad financial services, leaves us with a list of eight “pure” asset managers.

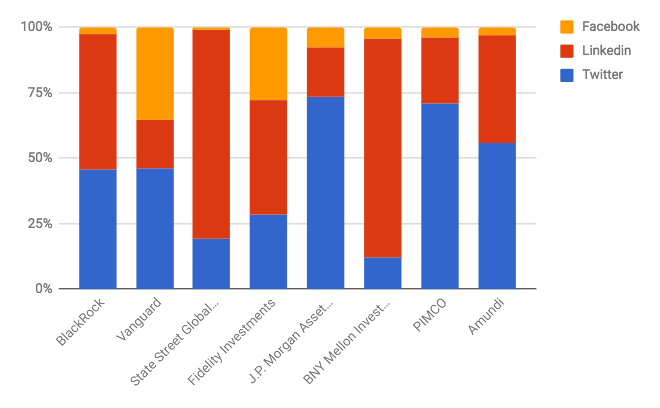

These fund companies average 450,000 followers across Twitter, LinkedIn and Facebook. At 45 percent and 41 percent for Twitter and LinkedIn, respectively, these two platforms represent the bulk of their audience. Facebook, the mightiest of all social networking platforms, commanded just 14 percent of all followers:

Table: Percentage Breakdown of Social Media Followers for Top Asset Managers

The overall number of followers is comparatively quite low for companies of their size, likely for several reasons:

Asset management is an industry that doesn’t want its content to go “viral.” As such, it may not be fair to compare the industry to, say, fashion or food.

Although some firms target retail investors, the industry is generally skewed toward institutions, where there are far fewer people to target.

The regulatory oversight of the fund industry requires a cautious approach to communication, which could limit the scope for creativity.

Is there a missed Facebook opportunity?

With its 2.2 billion users, it’s hard for any business to ignore Facebook. Indeed, there are countless articles about “B2B marketing on Facebook,” which make the following core points:

Your target clients are very likely to be on Facebook (in North America, the penetration rate is at over 70% of the population).

Decision-makers spend a lot of time on Facebook.

Facebook allows for very precise targeting, including by industry and job.

For these reasons, Facebook is by no means ignored by fund managers; the adoption rate of the platform by the industry is at 100%, and most pages are maintained with regular, customized posts. It’s just that the funds are not putting forth the best effort. Indeed, in my survey of recent points like this one, this one and this one, the posts are almost entirely company-centric and feel more like check-the-box exercises than catalysts for engagement.

When you take into account Facebook, Inc.’s other properties, rather than just the Facebook platform, the asset management industry fares even worse. Instagram, which Facebook bought in 2012 when it had 30 million users, now has one billion users. That’s more than all of LinkedIn’s and Twitter’s users combined. And yet, Blackrock’s follower count barely exceeds a paltry 2,300. Its peers have even fewer followers or are absent altogether.

What could customer-centric posts look like?

Consider these fintech startups: Transferwise (500,000 followers overall, 400,000 on Facebook) is a foreign exchange and money transfer company that talks about immigrants. Wealthsimple (170,000 followers, 85,000 on Facebook), a roboadvisor, brings storytelling to savings and wealth. It has also invested heavily in developing its Instagram presence.

Would this type of communication work for traditional asset management firms as well? Potentially, but a scroll through their blogs and social posts suggests they haven’t really tried. That’s a shame, because as a recent PWC report noted, “Great brands aren’t built on product pitches. By crafting stories that put customers first, great brands reach the hearts and minds of their customers and create a greater sense of loyalty in this fast-changing world.”

Conclusion

The asset managers’ lack of traction on Facebook is not an industry issue but a content issue. Their focus on “company-centric” rather than “customer-centric” posts explains their lackluster social media performance. A new approach that embraced Facebook and Instagram would engage more prospective investors and open up new pathways for engagement, especially with younger investors.

Of course, my analysis begs the question: Does Blackrock really need a better communication strategy or more Facebook fans? Perhaps not for the time being. Afterall, the company had record inflows this year, and its scale advantages won’t be easily dented. Yet for almost everyone else, a more aggressive social marketing approach that emphasized Facebook and Instagram could make a real difference. And here’s the kicker: The first-mover advantage for a smaller, scrappier fund manager is there for the taking. I’ll bet you a steak on it.

George Aliferis is a company director and consultant with an extensive background in financial markets and digital marketing. After a decade in business development and marketing across alternative investments, derivatives and ETFs for employers such as Deutsche Bank and Source (now PowerShares), George made the leap into the world of digital video and content via Orama. He is now combining his experience in both the financial world and creative industries to help financial innovators grow with data-driven marketing solutions.