Guest Opinion: The Digital Evolution of Stock Trading

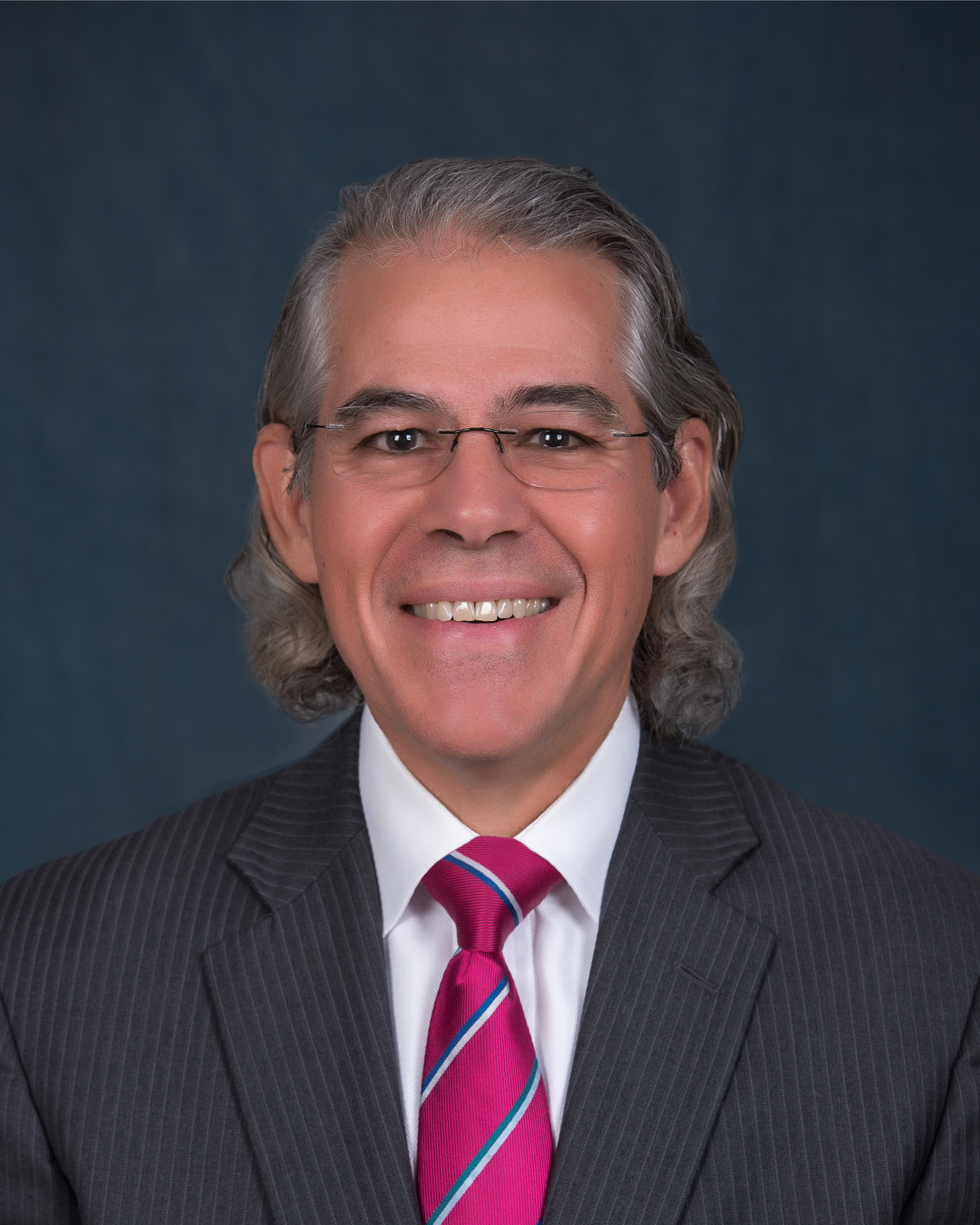

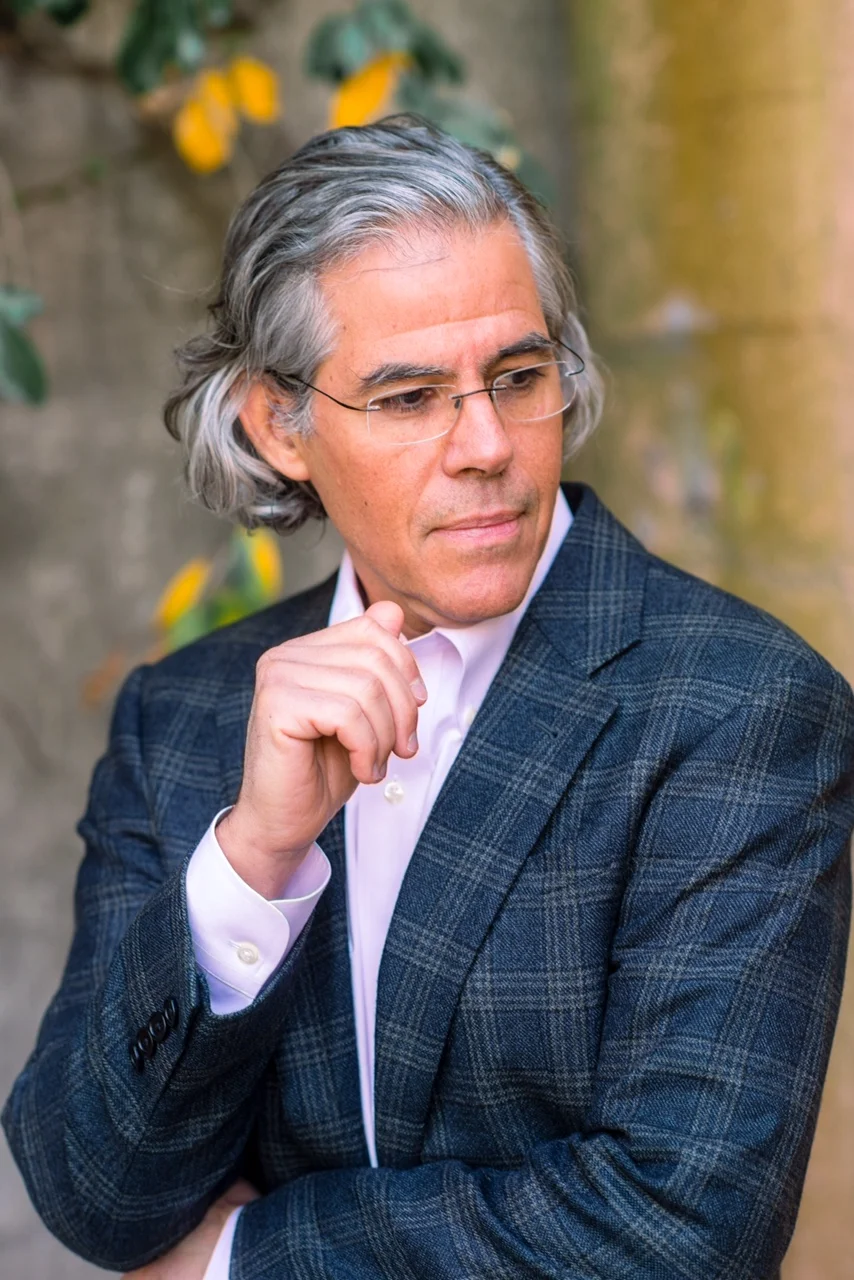

/Some people in life you don’t forget. For me, one of these people is Shawn Dorsch, president of Clear Market Holdings, an electronic trading company. I first met Shawn at Art’s Barbecue in Charlotte, NC, after he agreed to be a mentor to our company. Shawn has the impressive skill of switching contexts effortlessly. One moment, he would be explaining to us the intricacies of the stock market. The next, he would be on the phone with an investor in Tokyo, rattling off Japanese.

Read More